In 2021, home prices will continue rising in most U.S. cities, and mortgage rates could stay around 3%, according to the Home Buying Institute (HBI). HBI anticipates that low inventory will remain a challenge for many homebuyers.

A recent report from Freddie Mac sums up the 2020 housing market: “Even though the overall economic recovery is uneven, the housing market has made a remarkable comeback. This surge in home sales has put pressure on housing inventory and resulted in an acceleration in house price growth.”

Here are five key predictions for the U.S. housing market in 2021.

1. Home prices will continue rising in most U.S. cities.

A recent housing market report from Realtor.com® showed that the median listing price for homes in the U.S. rose by 12.9% in the first week of October, compared to a year earlier. As of Oct. 31, Zillow predicts that U.S. home values will rise 7.9% during the next year.

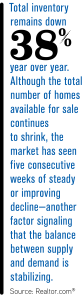

2. Housing market inventory will remain tight.

According to Realtor.com®, as of October 2020, total inventory remains down 38% year over year. But the report also states the balance between supply and demand is stabilizing. HBI forecasts a continuation of these trends at least into the first part of 2021.

3. Home sales will remain steady.

After an initial slowdown due to the coronavirus, home sales activity increased. According to Freddie Mac: “In August, new home sales surpassed 1 million units at an annualized rate, the highest since Q2 2006.” HBI predicts that home sales will continue at a strong pace in 2021.

4. Mortgage rates will hover around 3% in 2021.

The U.S. weekly average 30-year fixed mortgage rate hit an all-time low of 2.86% in the second week of September. According to Freddie Mac, “Given weakness in the broader economy, the Federal Reserve’s signal that its policy rate will remain low until inflation picks up, and with no signs of inflation, we forecast mortgage rates to remain flat over the next year.” The report forecasts mortgage rates will remain unchanged at 3% in 2021.

5. It will be another good year for refinancing.

According to HBI, there are still millions of homeowners in the U.S. who could benefit from refinancing, thanks to low mortgage rates.

HBI anticipates: “In most local real estate markets across the U.S., sellers will continue to have the upper hand in 2021, due to tight inventory conditions. Home prices will keep climbing in most parts of the U.S., and borrowers will continue to enjoy low mortgage rates throughout next year.”

Photo: iStock.com/GeorgePeters