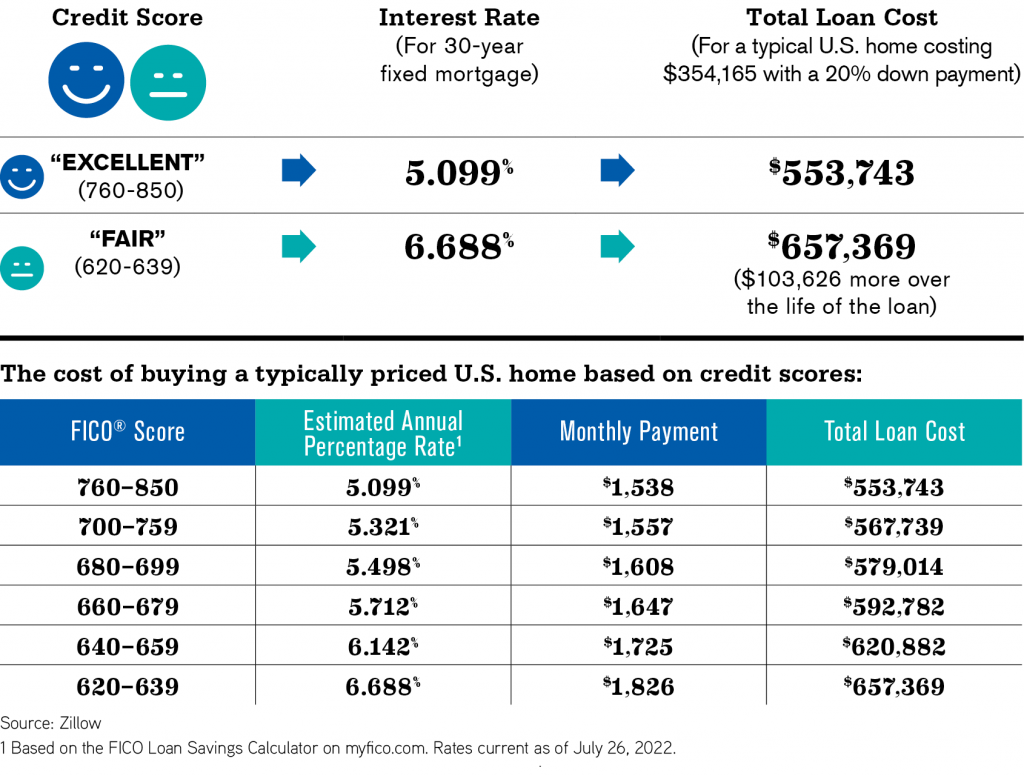

Elevated mortgage interest rates are causing issues for potential homebuyers who have lower credit scores. According to a recent study by Zillow, buyers with a “fair” credit score could end up paying up to $288 more in mortgage payments per month when compared to those with “excellent” credit scores. Doing the math, these “fair” credit-score owners could end up paying an additional $104,000 over the course of a 30-year mortgage—a number that is no laughing matter.

The study went further to break down what each FICO® credit score bracket may see in terms of average interest rates and total loan costs.

The data above shows that there is a direct correlation between credit security and homeownership rates, according to Zillow.

To read Zillow’s full analysis, visit bit.ly/credit-score-mortgage-rates.

Photo: iStock.com/ Istoma