The weak industry recovery will continue, but could be upset by pricing that first-time buyers can’t afford

By Michael Chazin

For a comprehensive real estate industry forecast, almost nothing compares to Emerging Trends in Real Estate® 2020 prepared by PwC and the Urban Land Institute. Based on completed surveys and interviews with more than 2,000 industry participants, the publication provides an outlook on real estate trends across the United States.

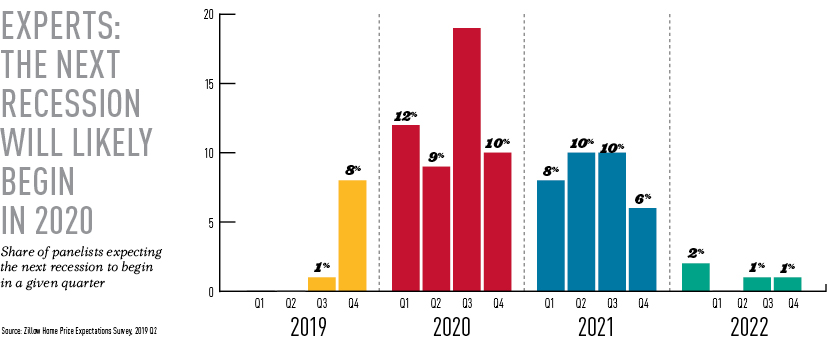

The current economic cycle, the longest in U.S. history, has resulted in palpable confidence in the real estate industry. Still, complacency is the wrong approach; some serious attention should be given to the prospects that the economy could downshift. It appears the economy isn’t as robust as many believe. The yield curve inversion that took hold and then deepened early last year leads the list of warning signals. Add in softer housing starts and year-over-year declines in residential permits, and it shows just how fragile the economy has become. In its latest survey, Zillow disclosed that nearly half of respondents said the next recession will commence in 2020. The main culprit for the housing recession, the organization said, is monetary policy. “The emerging trend for real estate demand in the decade ahead isn’t just for softer demand, it’s for dramatically softer demand,” said one real estate professional interviewed for Emerging Trends.

Millennials Meet “Golden Girls”

Co-living appeals to those in their 20s and 30s who find cost-savings through rent sharing. Additionally, roommates often share common interests, values and concerns. These living arrangement are not just for Gen Zers and millennials; they have started to show up in living arrangements for older adults. The pop-culture reference for this trend is the “Golden Girls” model.

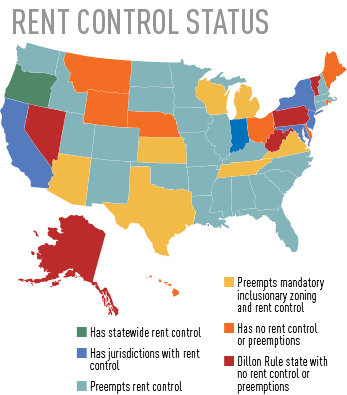

While a reservoir of optimism remains, there are signs the market is unraveling. The home ownership rate, currently at 64%, is at its lowest level since the 1960s. Single-family pricing has outstripped household incomes, and affordability has reached the breaking point even in markets that previously boasted lower-cost housing. Employers in need of workforce housing have started to get involved. Microsoft, for example, announced a three-year $500 million investment to spur housing development across Puget Sound. Local governments are also getting involved. In October, California passed legislation that caps rent hikes for the next decade.

A shortfall in workforce housing sets the stage for residential rent control, and many in the industry fear this will spread. Local rent-control and other regulatory tactics have surfaced as “transformational business wildcards.”

Sales of single-family home are being influenced by multiple opposing signals. Favorable trends include job growth, income growth, household formation and more accommodating monetary policy. Headwinds arise from issues such as the elimination of the mortgage interest deduction as well as a growing number of cities eliminating single-family zoning.

Source: Zillow Home Price Expectations Survey, 2019 Q2

“Into that mix add a relatively unknown trend: households whose adult residents have the means to own homes but choose to rent,” said another interviewee in Emerging Trends.

The current recovery never fully took hold, is nearing its end and may not be wide-reaching enough to pull in aspiring first-time buyers. This leads to a first-ever phenomenon for recoveries: Home purchases arise mostly from purchases by current homeowners, while first-time buyers are largely out of the picture. Estimates predict upwards of 1 million new rental households per year. Growth estimates are so strong that developers from the commercial and residential sectors have been attracted to the multifamily space.

In addition to apartments, single-family rentals are also a growth area. Single-family-home renters come to that market out of necessity. They’re either early-career adults who have yet to form families or older adults who want a home without ownership responsibilities.

As young adults form new households, their take-home pay and ability to save for down payments takes them out of a path to ownership. Now, as renters, they worry about the widening gap between monthly take home pay and increasing monthly rental charges.

Supply/demand imbalances for senior housing exist in some—not all—markets across the U.S. The occupancy rate for senior housing stood at 88.1% in the first quarter of 2019, a seven-year low. As supply outpaces demand, some operators in select metro areas face challenging market conditions. Senior housing developers overbuilt in 2018 in anticipation of the baby boomers who are expected to retire over the next decade.

It seems that baby boomers have stolen the headlines forever. With this report, millennials come into their own and have perhaps become more important in the homebuying arena.

Millennials will continue to account for the largest segment of buyers in 2020, accounting for 45% of mortgages compared to 17% for boomers. With the largest group of millennials turning 30 in 2020, realtor.com predicts that it will be a peak year for millennial homebuying. The phenomenon of “hipsturbia” also is largely attributable to millennials. As home prices trend upward, millennials look for more affordable housing by moving outward. As suburbs seek to become hip destinations in their own right, they try to emulate 24-hour urban neighborhoods. The most successful suburbs—“hipsturbs”—provide access to transit, walkability, abundant retail and recreation opportunities.

The live/work/play formula helped revive inner cities a quarter-century ago. There’s no reason to believe that it won’t do that again in the “right” suburbs.

For more information on housing trends, visit the National Association of REALTORS®.