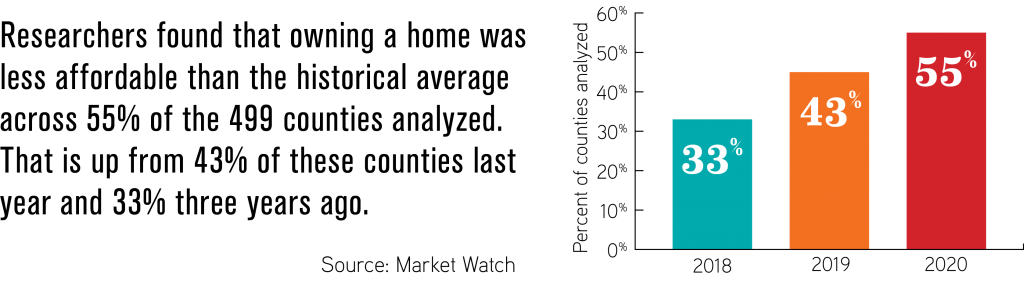

In its Q4 2020 U.S. Home Affordability Report, ATTOM Data Solutions reported that median home prices of single-family homes and condos were less affordable than historical averages in 55% of counties. Median home prices in Q4 2020 were up at least 10% from Q4 2019 in 79% of the counties included in the report.

Rising wages and falling mortgage rates helped keep median home prices close to affordable for average wage earners. But home price appreciation outpaced average weekly wage growth in the fourth quarter of 2020 in 92% of the counties analyzed in the report. With prices rising faster than earnings, major homeownership expenses consumed 29.6% of the average wage—above the 28% benchmark lenders prefer.

Todd Teta, chief product officer, ATTOM Data Solutions, says: “Home prices have continued rising throughout 2020, and the housing market has remained remarkably resilient in the face of the brutal economic fallout from the coronavirus pandemic. The future remains wholly uncertain, and affordability could swing back into positive territory. But for now, things are going in the wrong direction for buyers.”

A low supply of entry-level homes along with low mortgage rates have driven prices higher. The S&P CoreLogic Case-Shiller Home Price Index is nearly 25% higher than its previous peak in 2006.

“Housing affordability, which had greatly benefited from falling mortgage rates, is now being challenged due to record-high home prices,” writes Lawrence Yun, chief economist at NAR, in a recent report on existing-home sales. “That could place strain on some potential consumers, particularly first-time buyers.”

Photo: iStock.com/Aleutie