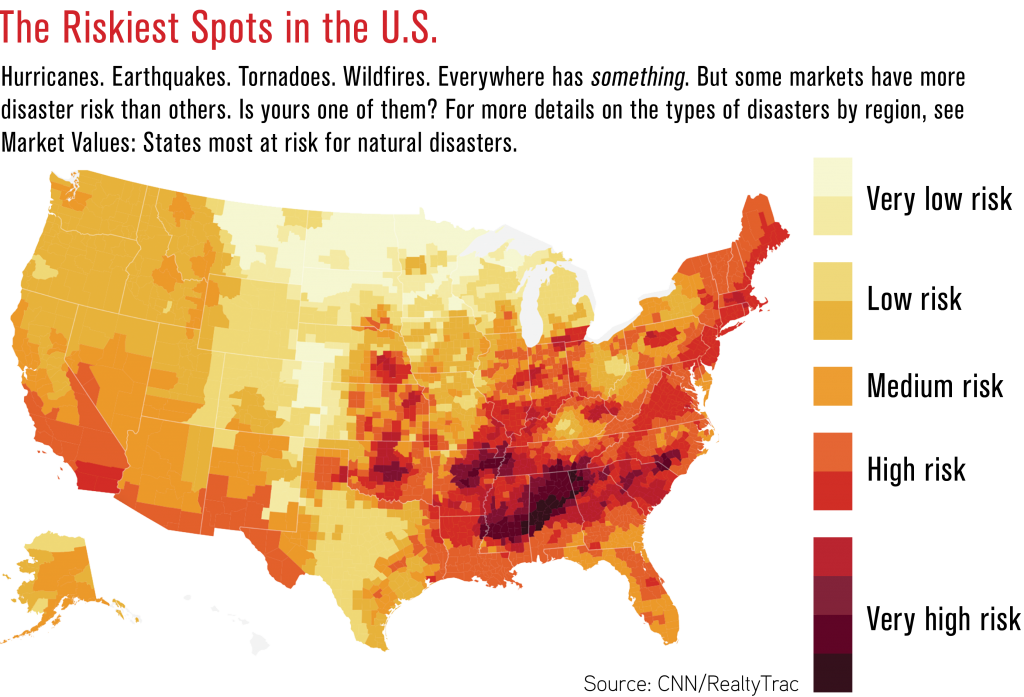

Agents need to know and plan for what’s required of them with regard to natural disaster disclosures

By Matt Alderton

When you live in southeast Texas, it feels as if Mother Nature is your best friend.

The warm weather is a constant hug, the gorgeous Gulf of Mexico a loyal companion and the spectacular beaches a bottomless source of entertainment. But even the best of friends fight sometimes, says local REALTOR® Julie Sanders, CRS, broker associate at SETX Properties in Nederland, Texas.

Sanders and her husband established their brokerage, The Neil & Julie Sanders Team, in 2007, just two years after Hurricane Rita ravaged the area in 2005. Then came Hurricane Ike in 2008, Tropical Storm Harvey in 2017 and Tropical Storm Imelda in 2019, after which was yet another local disaster: a chemical plant explosion in Port Neches, Texas.

Sanders and her husband established their brokerage, The Neil & Julie Sanders Team, in 2007, just two years after Hurricane Rita ravaged the area in 2005. Then came Hurricane Ike in 2008, Tropical Storm Harvey in 2017 and Tropical Storm Imelda in 2019, after which was yet another local disaster: a chemical plant explosion in Port Neches, Texas.

“It was Thanksgiving, so we left a raw turkey and two cooked pies in the refrigerator and went to Houston,” recalls Sanders, who was evacuated along with 60,000 of her neighbors. Homes near the plant, she says, suffered cracked swimming pools, downed fences, caved-in ceilings, smashed windows, broken rafters, loose bricks, blown-out doors, split Sheetrock and more.

Residents were still recovering in summer 2020 when two more hurricanes struck southeast Texas in rapid succession: Hurricanes Laura and Delta. “It seems like there’s just constant construction here because of disaster relief.”

It’s a lot for one region to take. Still, people continue to live in southeast Texas because of its many treasures. Like residents, the real estate market is resilient. Defiant, even. But it is not naïve. Among the many reasons homes in southeast Texas continue to sell, Sanders suggests, is because local REALTORS® have what it takes to reassure risk-averse buyers: education and ethics.

Disclosure do’s and don’ts

It might sound counterintuitive—humans’ first instinct is to hide flaws rather than expose them—but fibbing about a home prone to disaster is like putting lipstick on a pig: Sooner or later, buyers will see it for what it really is. So you might as well tell the truth from the start, Sanders says.

In fact, you should assume that you’re legally bound to do so, advises New York-based real estate attorney David Reischer, CEO of LegalAdvice.com. “It is necessary to fully disclose all information important to the sale and that may affect a buyer’s decision to purchase,” he says. “Real estate professionals have a duty to disclose hazards, defects and other various factors or otherwise risk facing a lawsuit for damages.”

Exactly what must be disclosed and when varies by state, according to Reischer, who recommends consulting local and state real estate associations to determine requirements in individual markets. In California, for example, all sales must include a Natural Hazard Disclosure Report that lets buyers know if a property is located in an area that’s prone to flooding, earthquakes or wildfires, among other things. North Carolina on the other hand, is a “buyer beware” state in which sellers can elect “no representation” on their seller disclosure form, which means sellers don’t have to disclose hazards or defects, although real estate agents are required to do so if prospective buyers ask. For that reason, REALTOR® Kasey Rabar, CRS, stresses the importance of disclosing material facts up front and encourages strict adherence to the ethics guidelines of the North Carolina Real Estate Commission and the National Association of REALTORS®.

“A seller doesn’t have to disclose that their home flooded unless a buyer specifically asks,” explains Rabar, who sells homes in North Carolina’s hurricane- prone Outer Banks as a broker associate with The VanderMyde Team at Coldwell Banker Seaside Realty in Kill Devil Hills, North Carolina. “As an agent, though, I will still disclose it—typically in the broker’s notes—because that’s usually the first question we get.”

Generally, the only information that doesn’t have to be disclosed is information about which sellers are ignorant. “A seller does not need to disclose risks that are unknown,” Reischer says. “In a lawsuit alleging that the seller failed to disclose a defect, the buyer will have to prove to the court that the seller knew or should have known about the problem. As such, the level of disclosure will vary depending upon the facts and circumstances.”

This is where things can get tricky, according to Sanders. Technically, sellers aren’t obligated to report information that pre-dates their ownership of a home. In her area, for instance, there might be homes that remained dry during Hurricane Harvey, but which flooded nine years prior during Hurricane Ike. “You really only have to put on the seller’s disclosure what you know to be factual,” she explains. “If you didn’t own your home during Ike, you don’t have to disclose that it flooded because you didn’t witness it. But if you know it did—because a neighbor told you, or because every house in your subdivision flooded—you should. It’s the ethical thing to do.”

Turning disasters into dividends

Like any real estate challenge—small closets, a bad location or a dated kitchen—disaster risk can be overcome with the right sales strategies. Here are a few worth trying:

Play up the positives: If susceptibility to disaster is a home’s biggest challenge, its readiness for disaster can likewise be its biggest asset. Because flooding in her market is such a routine occurrence, for example, Rabar markets it loudly and proudly when a home is located in a favorable flood zone. “If a home is in a [low-risk] flood zone, it goes in the header on the primary listing picture and high up in the listing notes, because that’s a huge plus for buyers in our area,” she says.

After Hurricane Harvey, REALTORS® in southeast Texas similarly emphasized in listings when homes survived the storm without flooding, according to Sanders, who says positive performance during a recent disaster can be a huge comfort to buyers.

After Hurricane Harvey, REALTORS® in southeast Texas similarly emphasized in listings when homes survived the storm without flooding, according to Sanders, who says positive performance during a recent disaster can be a huge comfort to buyers.

But what if a home is in a high-risk flood zone, or didn’t fare so well in a recent storm? Although you have to disclose hazards and defects, you don’t have to market them, points out Catherine Bierwith, CRS, a REALTOR® at Windermere Real Estate in Alameda, California. After all, a good school district is still a good school district, and a spectacular yard is still a spectacular yard. “I like to answer questions before they even come up, and I do that in the disclosures package that people receive before they even see a house,” Bierwith says. “In the marketing, though, it’s all about how pretty the home is or what a great location it has.”

Make insurance easy: You can’t eliminate risks, but you can make them more palatable by helping buyers find and obtain insurance. When she sells homes that are located in floodplains or fire zones, for example, Bierwith always includes in the disclosures package a quote from a local insurance broker.

Sanders has done the same, and also urges sellers in her market to get their windows and roofs windstorm-certified, which sweetens Gulf Coast real estate deals by making it easier for buyers to obtain affordable windstorm insurance.

Emphasize mitigations: Rabar says disasters can raise awareness to mitigate future damage. That’s because homeowners typically make investments afterward that make the home more resilient to future events.

In North Carolina, for example, flood-prone homes are typically built on stilts with reverse floor plans; after a flood, homeowners often reconstruct lower levels for “easy cleanup”—installing laminate vinyl flooring and other flood-resistant materials that are cheap and easy to replace.

“There are certain construction techniques that can help protect a home, so I try to highlight those for buyers,” says Rabar, who sometimes calls in a general contractor to walk prospective buyers through existing or potential disaster-proofing improvements.

In California, Bierwith furnishes information about advancements in firefighting, which similarly increases buyers’ comfort and confidence. “There now are wider roads and more firebreaks in fire zones,” she says. “Things get better after every fire season.”

Ultimately, what’s most needed is patience, persistence and a positive attitude, according to Sanders. “Our community is weary,” she says of southeast Texas, “but we can make the process better by providing documentation and being informed. Pretty much all properties are sellable. It just comes down to pricing them appropriately and giving potential buyers the details they need to make informed decisions.”

Digital Dilemma: Should Real Estate Websites Show Disaster Risk?

Because they make home searches easy and informative, homebuyers flock to real estate websites like Redfin, Trulia and Zillow. Citing inaccurate home valuations and incomplete, out-of-date listings, however, many REALTORS® worry that they’re more hurtful than helpful. Now, there’s a new reason to either love or loathe some real estate websites: In August 2020, Realtor.com® became the first major real estate website to publish information about flood risk for the homes that appear on its site.

“Historically, determining a property’s flood risk was an onerous process,” Realtor.com® senior vice president of product Leslie Jordan said in a press release. “By surfacing this information upfront, consumers can avoid surprises and have all the information they need to make informed decisions and feel confident about the homebuying process.”

But the same information that can help buyers could hurt sellers by devaluing their homes, critics worry. In fact, a 2020 study by the National Bureau of Economic Research found that flood risk reduces property values by an average of 2.1% nationwide.

It estimates that there are at least 3.8 million floodplain homes in the United States that are discounted by 0.6% to 4% because of their flood risk.

If you live in an area prone to natural disasters, learn how you can help your community when they happen with the free RRC webinar recording “Bring Relief and Build Community During Natural Disasters.”

Photo: iStock.com/tiero