First-time homebuyer trends point to an expanded market in the near future. The National Association of REALTORS® reports that about 33% of all home purchases are made by first-time buyers. More importantly, this means that almost one-third of all homebuyers look for assistance from real estate agents.

“There has been a lot of discussion in the marketplace that younger people today may not be as interested as prior generations in buying a home and being tied down to one location,” says Joe Mellman, senior vice president at credit bureau TransUnion.

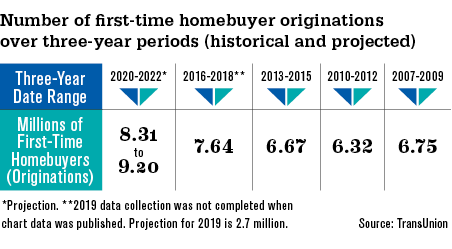

By the Numbers

67% of respondents believe that a high credit score is necessary to purchase a home.

41% of respondents believe a high down payment is required to purchase a home.

Source: TransUnion

However, this may not be the case. A survey conducted by TransUnion in October 2019 showed that the average age of first-time buyers has gone down since the Great Recession, from 39 in 2010 to 36 in 2018.

“Younger people may have in fact been deterred from home purchases by challenges they faced in the financially difficult times of the last decade,” Mellman explains.

“While we’ve recently seen a boom in refi activity, actual homeownership rates are down,” Mellman says. “Challenges have included high home prices, sluggish wage growth and limited housing inventory.”